6 Ways to Increase Your Business Sale Price

ByJulian Gette

Workast publisher

Workast publisher

You've spent years building your business. Late nights, tough decisions, personal sacrifices - all leading to a profitable operation that generates consistent revenue. Now you're considering selling, and you want to get the maximum price possible.

Most business owners assume their sale price is fixed based on current revenue and profit. They think buyers will simply apply a multiple to earnings and make an offer. That's not how it works.

The difference between an average sale and a great sale often comes down to specific actions the owner took in the 12 to 24 months before going to market. These aren't expensive renovations or dramatic business overhauls. They're strategic improvements that address exactly what buyers care about most.

Smart sellers also understand that choosing the right company to represent them makes a substantial difference. Professional M&A advisors with industry expertise can increase sale prices by 6% to 25%, but beyond that, there are concrete steps you can take to maximize your business value before ever going to market.

The gap between what your business could sell for and what it actually sells for can be hundreds of thousands of dollars. Understanding what drives value and taking action on it changes your outcome significantly.

Buyers don't want to buy a job. They want to buy a business that runs without the current owner.

If you're personally handling all sales calls, managing key customer relationships, or making every operational decision, buyers see risk. What happens when you leave? Will customers stay? Will employees know what to do? Can the business maintain performance?

This owner dependency directly reduces what buyers will pay. They're either discounting their offer to account for hiring someone to replace you, or they're walking away entirely.

A manufacturing business generating $500,000 in annual profit might seem worth $1.5 million at a 3x multiple. But if the owner handles all customer relationships and technical problem-solving, buyers see that they'll need to hire a manager at $120,000 per year. That's a $360,000 reduction in value over three years. Your actual offer becomes $1.14 million.

The fix: systematically remove yourself from daily operations. Hire or promote managers who can handle key functions. Document processes so anyone can follow them. Train your team to make decisions. Build systems that work without you.

Start by identifying every task only you can do. Then create a plan to delegate, document, or systematize each one. If customers call you directly, route calls through a customer service manager. If you handle all technical decisions, train your technical team and give them decision-making authority.

Customer concentration is one of the biggest red flags for buyers. If 40% of your revenue comes from three customers, your business value tanks.

Buyers calculate risk. A single large customer leaving could devastate the business. That risk gets priced into their offer through lower multiples or reduced purchase prices.

The threshold varies by industry, but as a general rule, no single customer should represent more than 10% to 15% of revenue. If your top five customers represent more than 40% of revenue, you have a concentration problem that will hurt your sale price.

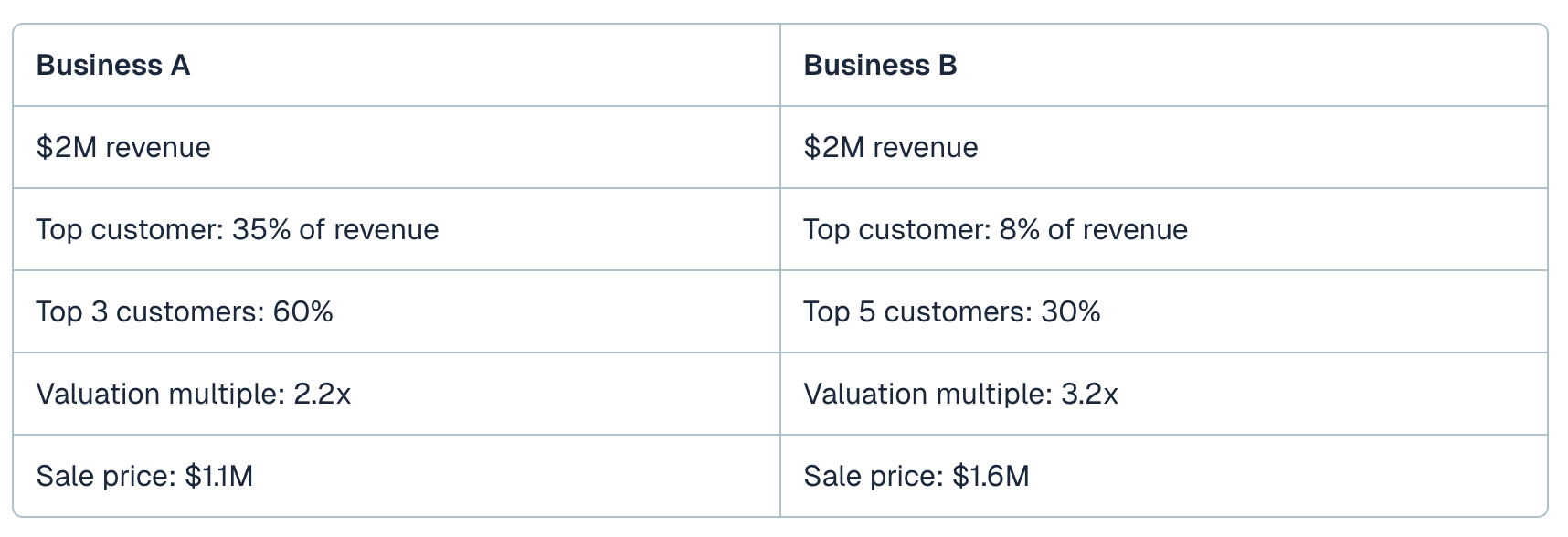

Example comparison:

The difference? $500,000 in sale price for businesses with identical revenue and profit.

How to fix it: Start diversifying 18 to 24 months before you plan to sell. Focus your sales and marketing efforts on acquiring new customers rather than growing existing accounts. If you have large customers, that's fine - just make sure you're also building a base of smaller customers so the mix improves.

Predictable revenue is worth more than unpredictable revenue. Buyers will pay a premium for businesses where future income is certain.

Month-to-month customer relationships create uncertainty. Sure, customers might renew, but they also might not. Buyers price in that uncertainty by offering less.

Long-term contracts remove uncertainty. If 60% of your revenue is locked in for the next two to three years, buyers can forecast future cash flow with confidence. That confidence translates directly into higher valuations and better multiples.

The impact is measurable. According to Harvard Business Review, businesses with more than 50% of revenue under contract typically command multiples that are 0.5x to 1.0x higher than similar businesses with no contracts.

For a business with $400,000 in annual earnings, that's a $200,000 to $400,000 difference in sale price.

How to implement this: Start converting customers to annual or multi-year contracts 12 to 18 months before selling. Offer modest incentives - a 10% discount for annual prepayment, additional services included with longer commitments, or price locks against future increases.

Not every business model supports contracts, but most can implement some form of commitment. Subscription businesses can offer annual plans. Service businesses can use retainer agreements. Even transactional businesses can implement prepaid packages or membership programs.

Messy financials kill deals and reduce sale prices. Buyers who can't understand your numbers either walk away or dramatically reduce offers to account for the uncertainty and risk.

Many small business owners run personal expenses through the business, use cash accounting that doesn't reflect true profitability, or lack organized financial statements that clearly show performance trends. This is fine for running the business day-to-day, but it's devastating when trying to sell.

Buyers and their accountants will scrutinize every number. If they find inconsistencies, missing documentation, or financial practices that raise questions, they'll either demand deep discounts or abandon the deal entirely.

Clean financials do three things. They increase buyer confidence, which leads to better offers. They speed up due diligence, which reduces the chance of deals falling apart. And they give you credibility during negotiations, making buyers more likely to accept your asking price.

What buyers want to see:

Three years of P&L statements prepared consistently

Clear documentation of revenue sources

Organized expense records with proper categorization

Balance sheets showing assets and liabilities

Clear separation of personal and business expenses

Documentation of any add-backs to earnings

If you've been mixing personal and business expenses, separate them completely at least 18 months before selling. If you're using cash accounting, consider switching to accrual accounting to better reflect true profitability. If you don't have organized financial statements, hire a professional bookkeeper or accountant to create them properly.

According to Entrepreneur, one of the top reasons business sales fall through is poor financial documentation that creates uncertainty during due diligence.

Buyers pay for future earnings potential, not past performance. A business that's growing is worth significantly more than one that's flat or declining, even if current earnings are identical.

Two businesses each generate $500,000 in annual profit. Business A has been flat for three years - $500K, $495K, $505K. Business B has grown steadily - $380K, $440K, $500K. Business B will receive offers 20% to 30% higher despite having identical current earnings.

Why? Buyers project future performance based on trends. A growing business suggests continued growth under new ownership. A flat business suggests maturity with limited upside. A declining business suggests problems that might worsen.

The trend matters more than the absolute numbers. A business earning $300,000 growing at 25% annually is often valued higher than a business earning $400,000 that's declining.

Growth indicators buyers look for:

Revenue increasing year over year

Customer count growing

Profit margins improving or stable

Market share expanding

New products or services gaining traction

If your business has been flat, focus on demonstrating growth in the 12 to 18 months before selling. Launch new products, expand into new markets, increase marketing spend to drive customer acquisition, or improve operations to increase margins.

Even modest growth changes buyer perception dramatically. A business that was flat for years but shows 10% to 15% growth in the most recent 12 months tells buyers that momentum is building and potential exists.

Research from Inc. Magazine shows that businesses demonstrating consistent growth in the 12-18 months prior to sale command premium valuations compared to flat or declining businesses.

Choosing who represents you in the sale directly impacts your final sale price. Industry data shows the right advisor increases sale prices by 6% to 25%. For a $2 million business, that's $120,000 to $500,000 in additional proceeds.

Most business owners either try to sell on their own or work with whoever was referred by a friend. Both approaches typically result in lower sale prices and higher rates of failed deals.

DIY sales rarely work well. Owners lack access to serious buyers, don't know how to market businesses effectively, make mistakes during negotiations, and often accept the first reasonable offer rather than creating competition among multiple buyers.

Working with the wrong advisor is almost as bad. A generalist advisor who rarely sells businesses in your industry won't understand your business's value drivers, won't have relationships with relevant buyers, and won't know how to position your business for maximum value.

The right advisor brings specific expertise in your industry, has relationships with buyers actively looking for businesses like yours, knows how to value businesses in your sector accurately, and can create competitive bidding situations that drive up prices.

What to look for in an advisor:

Recent deals closed in your industry (within past 24 months)

Access to relevant buyer networks

Track record of multiple bids on listings

Understanding of your business model and value drivers

Proper fee structure aligned with your success

According to the International Business Brokers Association, businesses sold with professional representation close at rates 60% higher than owner-operated sales and typically achieve sale prices 20-30% above market comparables.

An advisor with deep industry experience can identify value drivers you might overlook, position your business to highlight strengths buyers care about, access buyers you'd never find on your own, and negotiate from a position of knowledge and strength.

These six strategies work independently, but their real power comes from implementing multiple improvements simultaneously.

A business that reduces owner dependence sees value increase. That same business also diversifying its customer base sees additional value increase. Add long-term contracts, clean financials, growth trends, and expert representation, and the compound effect is dramatic.

Most of these improvements don't require significant capital investment. They require time, attention, and strategic focus. That's why starting 18 to 24 months before you plan to sell is ideal. You have time to make changes, demonstrate results, and show buyers a business that's positioned for continued success.

The business owners who achieve premium sale prices aren't lucky. They're strategic. They understand what drives value and they take action on it well before going to market. Just as effective business growth strategies compound over time, these sale preparation steps build on each other to maximize your final outcome.

The result is offers that reflect not just current performance, but the full potential of the business you've built.