Best Business Credit Report Companies for Building Credit and Optimizing Cash Flows

ByJulian Gette

Workast publisher

Workast publisher

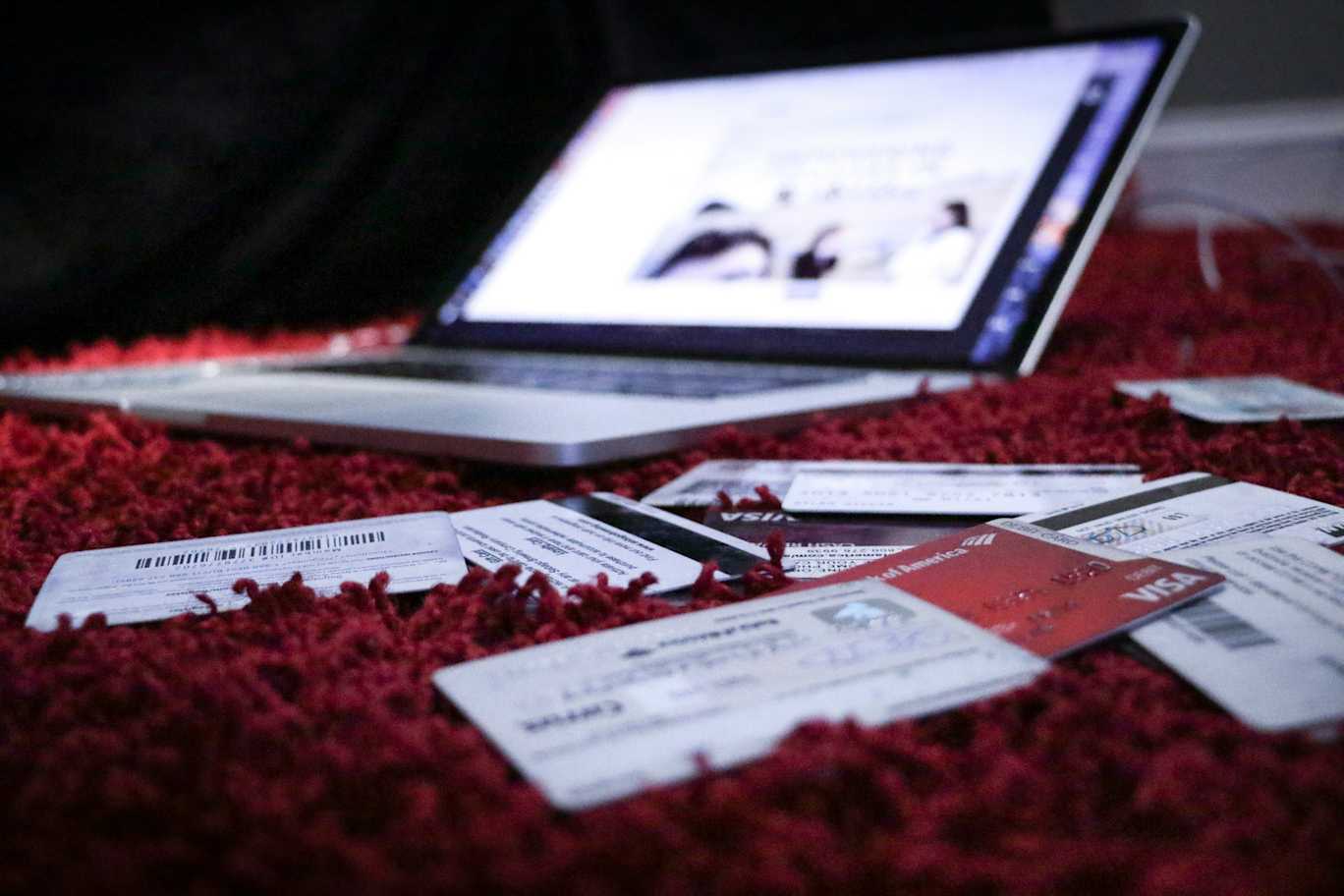

Many owners focus on sales, yet cash still feels tight when bills come due before customers pay. What often sits in the background is how business credit report companies shape the terms a firm gets, which directly influences day-to-day cash flow and the ability to plan purchases confidently.

Suppliers frequently look at a business credit report before offering net 30 invoices or other trade credit. When the report shows consistent payment history, vendors tend to view the account as predictable, making it easier to delay outflows without damaging relationships. However, when the record looks thin or spotty, suppliers may require payment up front, tightening working capital at the exact moment inventory or materials are needed.

Lenders and card issuers also price risk, so stronger credit signals can translate into lower interest costs and smaller monthly payments. Research summarized in the NSBA Small Business Access to Capital Study highlights how access to credit ties into operating stability.

Business credit reports serve two strategic functions: building creditworthiness and managing cash flow. Understanding both helps owners make better decisions about financing, vendor relationships, and timing.

Credit management works best when it’s treated like part of monthly operations, not a once-a-year financing task. When owners review bureau updates alongside AR/AP aging and upcoming supplier reorders, they can spot term risk early and adjust purchasing, payment timing, or financing before it becomes an operational fire drill.

Strong business credit enables better payment terms from suppliers. Net 30 or net 60 arrangements reduce cash outflow pressure by giving the business time to collect from customers before paying vendors. This timing advantage compounds when multiple suppliers extend similar terms.

Lower interest rates on financing directly improve monthly cash flow margins. Ongoing business credit monitoring can help spot reporting errors or developing issues early, before an application is declined or a vendor reduces terms and disrupts operations. That visibility helps teams time draws, renewals, and supplier orders so cash stays predictable in slow weeks.

Credit reports also influence vendor trust, determining whether suppliers extend trade credit at all. A thin file often means prepayment requirements, while a solid payment history opens doors to better arrangements. Monitoring credit helps anticipate financing obstacles before they disrupt operations, giving owners time to address issues proactively.

FairFigure sits more as a monitoring layer alongside the major bureaus, aimed at helping you notice changes early and respond before they affect terms or approvals. With business credit monitoring from FairFigure, you can track updates over time instead of pulling a one-time report and moving on. That can be helpful for spotting things like missing tradelines, unexpected score drops, or reporting errors that could influence vendor decisions, pricing, or financing options.

Pros

Monitoring-focused, helpful for staying ahead of negative changes

Useful for spotting errors early and protecting vendor terms

Clear fit for owners who want ongoing visibility, not one-time snapshots

Cons

Monitoring does not automatically add new tradelines to your file

You still need the underlying bureaus to have data for the strongest insights

Conclusion: A strong pick for ongoing oversight and early-warning visibility. Rating: 4.5/5

Dun & Bradstreet is the bureau many suppliers default to when deciding whether to extend net terms. Its PAYDEX score (1 to 100) is heavily driven by payment timeliness, so it rewards consistent, early payments on reporting invoices. The D-U-N-S number is central here, since vendors typically report under that identifier. If your legal name, address, or phone formatting is inconsistent across accounts, your file can fragment, and that can slow progress even if you pay perfectly.

Pros

Widely used for trade credit decisions, especially with suppliers

PAYDEX is straightforward and strongly tied to payment behavior

Strong value if you rely on net 30 and net 60 vendor relationships

Cons

File creation and matching depend on clean identifiers (D-U-N-S, address)

If vendors do not report, your positive behavior may not show up

Conclusion: The most important bureau for trade credit visibility in many industries. Rating: 4.7/5

Experian Business tends to blend payment performance with broader firm context. Its scores commonly run from 1 to 100 and can factor in trends like recent delinquency, industry risk signals, and company profile data. Experian reports may also include collections and public records, which can influence how lenders and vendors interpret your risk even if your trade payments are mostly on time. For businesses that use cards, lines of credit, or financing products beyond basic vendor accounts, Experian often shows up in underwriting workflows.

Pros

Good coverage for lenders and credit issuers beyond supplier trade terms

Includes broader signals like collections and public records when applicable

Helpful for understanding overall risk presentation, not just invoice timing

Cons

Negative items can outweigh otherwise solid trade payment habits

Scoring inputs can feel less transparent than a pure payment index

Conclusion: A solid bureau for understanding how lenders may price and approve you. Rating: 4.3/5

Equifax Business often provides multiple scores and indicators that highlight different angles of risk. Depending on the report, you may see a payment index, a credit risk score, and sometimes a business failure score, which looks at distress patterns that can concern lenders. The upside is that you get a more layered view of how your company compares to similar firms, not just whether invoices were late. The downside is that it can take more time to interpret what is driving changes, especially when updates come from different data sources.

Pros

Multiple scoring views help separate payment behavior from broader risk

Useful for comparisons across similar businesses and credit profiles

Can be influential in credit decisions depending on the lender or vendor

Cons

More complex to interpret than single-score models

If inputs are outdated or mismatched, it can skew the story

Conclusion: Great for a deeper risk view, especially if you borrow or plan to borrow. Rating: 4.2/5

CreditSafe is widely used in B2B credit decisioning, particularly where suppliers want fast, practical risk checks on customers and partners. Its strength is trade-focused intelligence, including payment experiences and company details that support credit limits and terms. For businesses in sectors with heavy invoicing relationships, CreditSafe can matter as much as a primary bureau, even if it is not the first name owners think of. If your main files at the big bureaus are thin, CreditSafe can still provide useful visibility when your trading partners rely on it.

Pros

Strong fit for supplier-driven industries and trade credit decisions

Useful when primary bureau files are thin or slow to populate

Focused on real-world payment and company verification signals

Cons

Relevance varies by industry and by which partners use it

Data can differ from other bureaus, requiring extra cross-checking

Conclusion: Worth monitoring if your vendors or customers reference it for terms. Rating: 4.1/5

Ansonia is a trade credit bureau that shows up in specific supplier ecosystems, especially where credit decisions hinge on payment experiences and vendor references. Think of it as highly relevant when your industry uses it, and easy to overlook when it does not. Ansonia can help add depth to a credit picture by reflecting how a business pays within a particular trade network. For owners, the practical move is to ask key suppliers which bureau they check. If Ansonia is on that list, it becomes important fast.

Pros

Highly valuable in trade sectors where Ansonia is a standard reference

Emphasizes supplier payment experiences that influence real credit terms

Can provide additional tradeline-like insight outside the big bureaus

Cons

Not universally used, so impact depends on your vendor network

Coverage can be uneven if your suppliers do not participate

Conclusion: A niche bureau with real leverage when your suppliers rely on it. Rating: 3.9/5

Credit bureaus focus on credit reporting, not coaching for day-to-day credit decisions. They collect payment and public-record data from lenders, suppliers, and courts, then package it into scores and reports. When a file is thin, a bureau generally cannot add history unless a data furnisher reports it.

A business credit building service works from the other direction. Tools such as Nav and eCredable help a company get existing payments counted by arranging reporting for eligible accounts or by offering a managed tradeline that reports activity. That means the service can influence what gets sent to credit bureaus, while the bureaus simply reflect what they receive.

Some businesses need both: bureau monitoring to catch errors and active building to create more reportable history. When comparing a service, business owners should verify which credit bureaus receive the data, what payment types qualify (such as utilities, rent, subscriptions, or invoices), and how quickly updates typically appear.

If a company is starting from zero, it needs to build the file before applying for larger limits. The goal is to separate personal activity from the business so reporting systems can match payments correctly.

Obtain an EIN from the IRS and use it on every application

Register for a D-U-N-S number with Dun & Bradstreet (free but takes about 30 days)

Open a business checking account and, if available, a business credit card in the company name

Keep deposits, bill pay, and reconciliations organized, including accounting and bookkeeping workflows

Add reporting trade credit by finding net 30 vendors that report to major bureaus

Verify that the business name, address, and phone match across the EIN record, bank, licensing, utilities, and supplier accounts

Small business files split easily when a suite number or formatting changes, and those mismatches can slow approvals. After the first invoices, check each bureau file for the new account and the identifiers. If nothing appears, ask the vendor which bureau receives the report.

Net 30 accounts let a supplier invoice today and give 30 days to pay. This timing preserves short-term cash when customer receipts lag behind inventory, fuel, or materials. In other words, the 30-day payment window is itself a cash flow tool, not just a credit-building mechanism.

Only vendors that report to credit bureaus can build the file. If the account does not report, it does not create a tradeline, and the business credit score may not move. Many owners start with three to five reporting vendors and keep purchases small but consistent.

On-time payment history feeds Dun & Bradstreet data and can improve a PAYDEX score because models weight it heavily. Late cycles show up quickly in scores, even when amounts are modest. Accordingly, cash planning reduces the risk of stacking unpaid invoices.

Aligning timing with financial forecasting for business success protects cash reserves. If terms outpace sales cycles, collections can follow, harming both cash flow and credit files.

Business credit can feel abstract until it changes the terms you get and the cash you keep in the bank. The takeaways below focus on moves that protect cash flow first, while building a stronger credit file in the background.

Pick one “source of truth” identity and make every account match it. Use the exact same legal business name formatting, address, phone, and suite/unit style everywhere: bank, utilities, vendor portals, invoices, licensing, and credit applications. Most “my credit file is thin” issues are really “my credit file is split.”

Treat net terms like a cash flow tool, not a badge. Net 30 only helps if your cash conversion cycle can support it. If you get paid in 45–60 days but you stack multiple net 30 invoices at once, you’re building a time bomb. Use terms to smooth timing, not to stretch reality.

Build with three to five reporting vendors, then stop “collecting” accounts. Open a small cluster of reporting trade lines, use them monthly, keep utilization sane, and pay early. Too many small accounts creates admin drag and increases the odds of missed payments — which hurts far more than one extra tradeline helps.

Pay earlier than “on time” when you’re chasing better supplier terms. For trade-heavy businesses, payment timeliness is leverage. Paying a few days early (consistently) is one of the simplest ways to strengthen your “we’re predictable” signal — and that’s what vendors price.

Check for new tradelines after the first two billing cycles. After two cycles, look for the account across the bureaus your vendors actually use. If it’s not there, don’t assume you did something wrong — ask the vendor where they report. You’re trying to confirm reporting behavior, not guess.

Set up “credit hygiene” as a monthly close task. Add one recurring step to your close: scan for score drops, new collections/public records, and mismatched identifiers. The goal is catching issues before a renewal, a limit increase request, or a supplier term review.

Separate monitoring from building so you don’t buy the wrong tool. If the goal is “avoid surprises,” choose monitoring and alerts. If the goal is “my file is thin,” choose reporting-enabled credit-building. Many owners buy monitoring, then wonder why nothing changes.

Use a simple decision rule for which report to pull. Negotiating supplier terms or applying for trade credit: prioritize the bureau your suppliers check (often Dun & Bradstreet in many industries). Applying for loans/cards/lines: pull the reports that show up most in underwriting for those products (often Experian/Equifax depending on lender). Doing both: monitor at least one trade-focused source plus one lender-focused bureau.

Don’t let disputes become a “project” — make them procedural. When you spot an error, document it once (invoice, proof of payment, correct address/name), file the dispute, and track it like any other ops ticket. The risk isn’t the error ��— it’s the delay before you notice it.

Align credit moves with an upcoming objective. Credit building works best when it’s tied to a timeline: “increase supplier terms before busy season,” “qualify for a line before hiring,” or “clean file before a lease renewal.” Random credit activity is how owners waste money on tools and still feel stuck.

Choosing the right provider starts with matching the tool to your goal: monitoring, building, or both. If you mainly need oversight, pick a tool focused on alerts and change tracking. If you need to build history, prioritize services that add reportable tradelines and help validate identifiers in your business credit report.

Pick tools that match your operating model — trade-heavy businesses should optimize for supplier-facing reporting and term protection, while finance-heavy businesses should optimize for underwriting visibility and renewal readiness.

Before enrolling, confirm which credit bureaus the service pulls from and which it reports to, since coverage varies. Weigh cost against value: free monitoring can be useful, but paid plans may include details, dispute support, or industry data.

Finally, choose options that fit your small business sector and the vendors you rely on for terms. The distinction between bureaus and building services matters here, as does the connection to cash flow established earlier. A provider that aligns with your industry relationships and reporting needs will deliver more practical value than one with broad but shallow coverage.