Swiss Company Formation vs. Other Jurisdictions: A Comparative Legal and Business Analysis

ByJulian Gette

Workast publisher

Workast publisher

Swiss company formation remains one of the most sought-after incorporation options for entrepreneurs, investors, and multinationals. Yet, when considering global corporate structuring, Switzerland competes with other leading jurisdictions such as Luxembourg, Singapore, Cyprus, and the Netherlands.

This article examines Switzerland’s position in the global landscape, assessing legal frameworks, tax regimes, regulatory environments, and operational factors, while highlighting both strengths and limitations. The aim is to provide entrepreneurs and corporate planners with an objective basis for choosing the most suitable jurisdiction.

Swiss incorporation is governed by the Swiss Code of Obligations, the Federal Act on the Commercial Register, and cantonal laws. All companies must be registered with the commercial register to acquire legal personality.

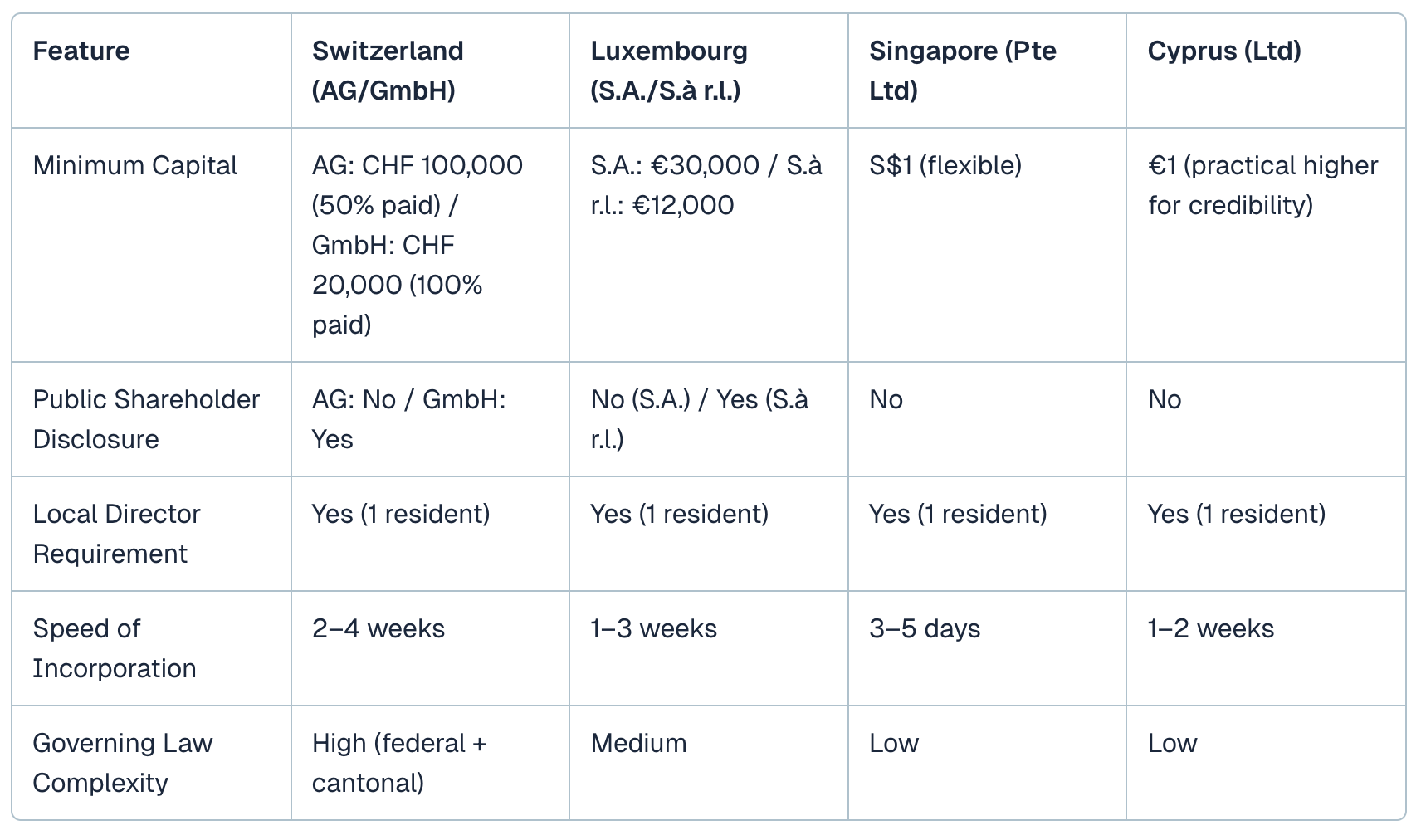

The most common corporate forms are:

Aktiengesellschaft (AG) — favoured for Swiss anonymous company formation due to shareholder privacy.

Gesellschaft mit beschränkter Haftung (GmbH) — accessible capital requirement and suitability for SMEs.

From a compliance standpoint, Switzerland maintains high corporate governance standards, aligning with OECD and FATF principles.

Switzerland demands more rigorous compliance and higher capital than most peers, but offers greater legal stability and international credibility.

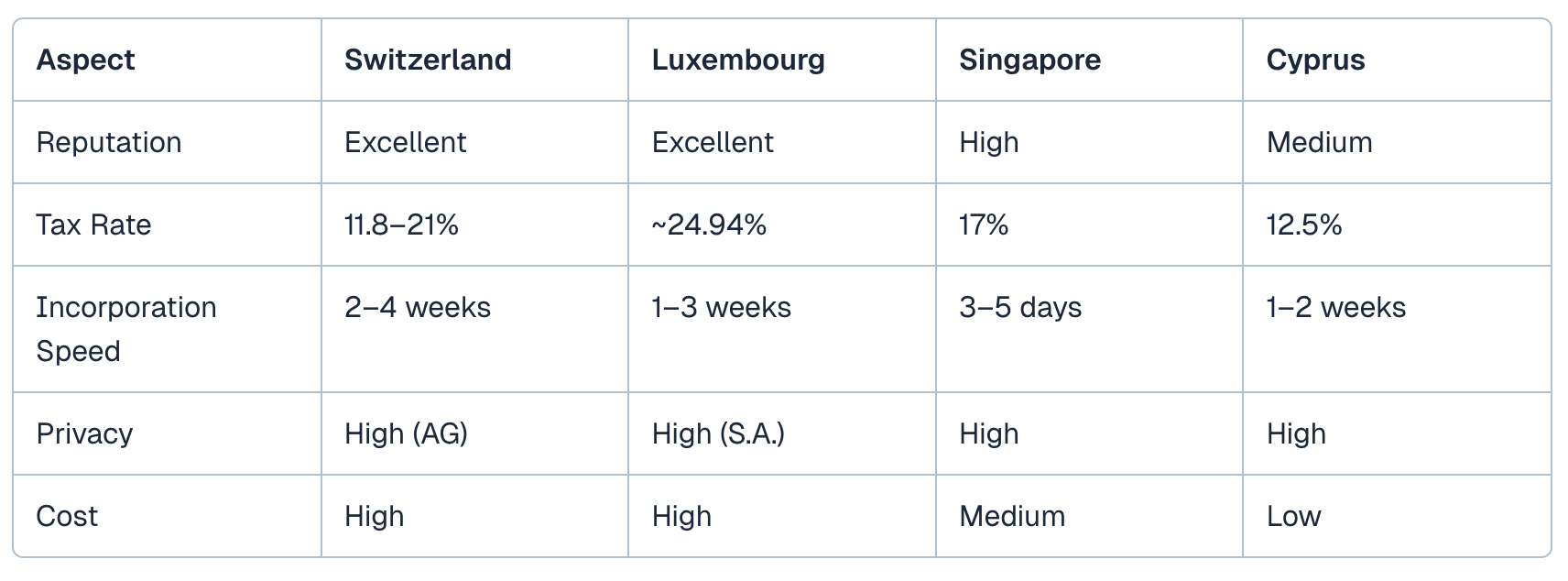

One of the key drivers of Swiss company registration is tax optimisation — but the country is not a low-tax jurisdiction by default. Corporate tax rates vary by canton:

Zug: ~11.8%

Schwyz: ~12%

Zurich: ~19.7%

Geneva: ~14–16%

By contrast:

Luxembourg: ~24.94% combined

Singapore: ~17% flat, with exemptions

Cyprus: 12.5% flat

Switzerland’s advantage lies in its double taxation treaty network, extensive for a non-EU country, and specific regimes such as holding company relief. However, it lacks the ultra-low headline rates of some competitors.

For entrepreneurs prioritising banking access, Switzerland remains unmatched in reputation and stability. Opening a corporate account is, however, more challenging than in Cyprus or Singapore, particularly for high-risk industries like blockchain.

Swiss crypto company formation often requires matching the banking partner to the business model early in the planning phase to avoid delays.

Swiss regulation is strict but transparent. For sectors such as financial services, asset management, or crypto, this means:

Clear licensing pathways (FINMA oversight).

AML compliance via membership in a recognised SRO, e.g., VQF.

Stability in rule-making compared to jurisdictions with frequent policy shifts.

In contrast, Cyprus offers lighter compliance but is under greater EU scrutiny, while Singapore combines efficiency with strong enforcement.

Swiss anonymous company formation via the AG structure is still appealing to investors valuing discretion. While beneficial owners must be disclosed internally and to authorities upon request, public anonymity remains a draw.

In Luxembourg, similar privacy can be achieved with an S.A., while Singapore and Cyprus also avoid public disclosure but apply stringent AML checks.

From a purely time-to-market perspective, Switzerland is slower than Singapore or Cyprus. Even with efficient notaries and prepared documentation, the 2–4 week average is longer than the 3–5 days possible in Singapore.

This is largely due to capital deposit verification, public deed execution, and cantonal variations in processing speed.

Swiss offshore company formation in a holding or trading structure is costlier than similar setups elsewhere. Notary fees, registry charges, and higher legal rates add to the initial outlay.

Yet for many multinationals, the higher costs are justified by:

Long-term operational stability.

The premium image of a Swiss entity.

Access to skilled professionals and infrastructure.

Finance: Swiss licensing enhances credibility with counterparties worldwide.

Crypto: Zug’s “Crypto Valley” offers a strong ecosystem and regulatory clarity.

Pharma & Life Sciences: Basel’s cluster rivals any in Europe.

Commodities Trading: Geneva remains a global hub.

By contrast, Singapore attracts fintechs with rapid licensing and proximity to Asian markets, while Cyprus appeals to online service providers seeking EU access with lower costs.

Internationally trusted jurisdiction.

Stable political and legal environment.

Favourable tax regimes in certain cantons.

Strong double taxation treaty network.

Sector-specific ecosystems (crypto, pharma, finance).

Higher capital requirements than most competitors.

Slower incorporation process.

Banking onboarding can be lengthy.

Higher legal and administrative costs.

From my experience advising entrepreneurs, Switzerland is the right choice when:

Reputation and investor confidence are critical.

The business operates in a regulated or high-value sector.

Long-term stability outweighs speed and initial costs.

It may be less suitable when:

Immediate market entry is essential.

Minimum capital is a barrier.

The business model is high-risk without the infrastructure to satisfy Swiss bank due diligence.

Swiss company formation stands out not because it is the cheapest or fastest, but because it delivers a combination of stability, reputation, and legal sophistication that few jurisdictions can match.

For entrepreneurs weighing Switzerland against other hubs, the choice comes down to strategic priorities: if trust, governance, and long-term credibility matter more than initial cost and speed, Switzerland remains a compelling option. If speed and minimal capital outlay dominate the decision, Singapore or Cyprus may be more practical.

Incorporation is never just about the legal act — it’s about aligning jurisdictional advantages with the business’s operational and strategic goals.

Frequently asked questions about the Swiss company formation

1) Is Swiss company formation better than Singapore or Luxembourg?

It depends on priorities: Switzerland offers reputation and legal stability; Singapore offers speed and low capital; Luxembourg offers strong EU positioning and fund expertise.

2) How long does Swiss company registration take vs. Singapore and Cyprus?

Switzerland: 2–4 weeks; Singapore: 3–5 days; Cyprus: 1–2 weeks. Switzerland is slower due to notarisation and capital deposit checks.

3) What are the capital requirements for Swiss AG and GmbH compared with peers?

Swiss AG: CHF 100,000 (CHF 50,000 paid in); Swiss GmbH: CHF 20,000 paid in. Singapore and Cyprus allow nominal capital (often raised for credibility).

4) Does Swiss anonymous company formation exist, and how is it different from Luxembourg and Singapore?

Yes, via an AG with non‑public shareholders; beneficial owners are still recorded. Luxembourg S.A. offers similar privacy; Singapore avoids public disclosure but applies strict AML/KYC.

5) Where is taxation lower: Switzerland, Singapore, Luxembourg, or Cyprus?

Headline rates are typically lowest in Cyprus and Singapore; Switzerland varies by canton (e.g., Zug competitive). Treaty networks and holding regimes can make Switzerland attractive overall.

6) Which jurisdiction is best for crypto ventures?

Swiss crypto company formation is strong in Zug’s “Crypto Valley” with clear FINMA guidance; Singapore is efficient but selective; Cyprus is lighter but under more EU scrutiny.

7) How difficult is bank account opening in Switzerland vs. other hubs?

Switzerland has the most stringent onboarding, especially for high‑risk sectors; Singapore is generally faster; Cyprus can be easier but varies by bank and profile.

8) What are the governance differences for Swiss AG/GmbH vs. Singapore Pte Ltd?

Swiss AG requires a board and one resident director; GmbH requires resident management and public shareholder listing. Singapore Pte Ltd needs at least one resident director and simpler filing.

9) Is Swiss offshore company formation a thing?

Not in a secrecy sense. Switzerland supports compliant holding/trading structures with treaty protection and robust governance—not a classic “offshore” model.

10) Which jurisdiction offers the fastest time‑to‑market for startups?

Singapore usually wins on speed; Cyprus is also quick. Switzerland prioritises legal certainty over speed.

11) For investor credibility, is Switzerland still the gold standard?

For many sectors—finance, pharma, deep‑tech—yes. Swiss company formation signals quality control, mature regulation, and long‑term stability.

12) When should a founder choose Switzerland over alternatives?

Choose Switzerland when reputation, governance, and predictable regulation outweigh lower capital, lower cost, and faster timelines available elsewhere.